All Categories

Featured

Table of Contents

The are whole life insurance policy and global life insurance policy. The money worth is not added to the death advantage.

The plan financing interest rate is 6%. Going this route, the interest he pays goes back into his policy's money value instead of a financial establishment.

Infinite Banking Concept Uk

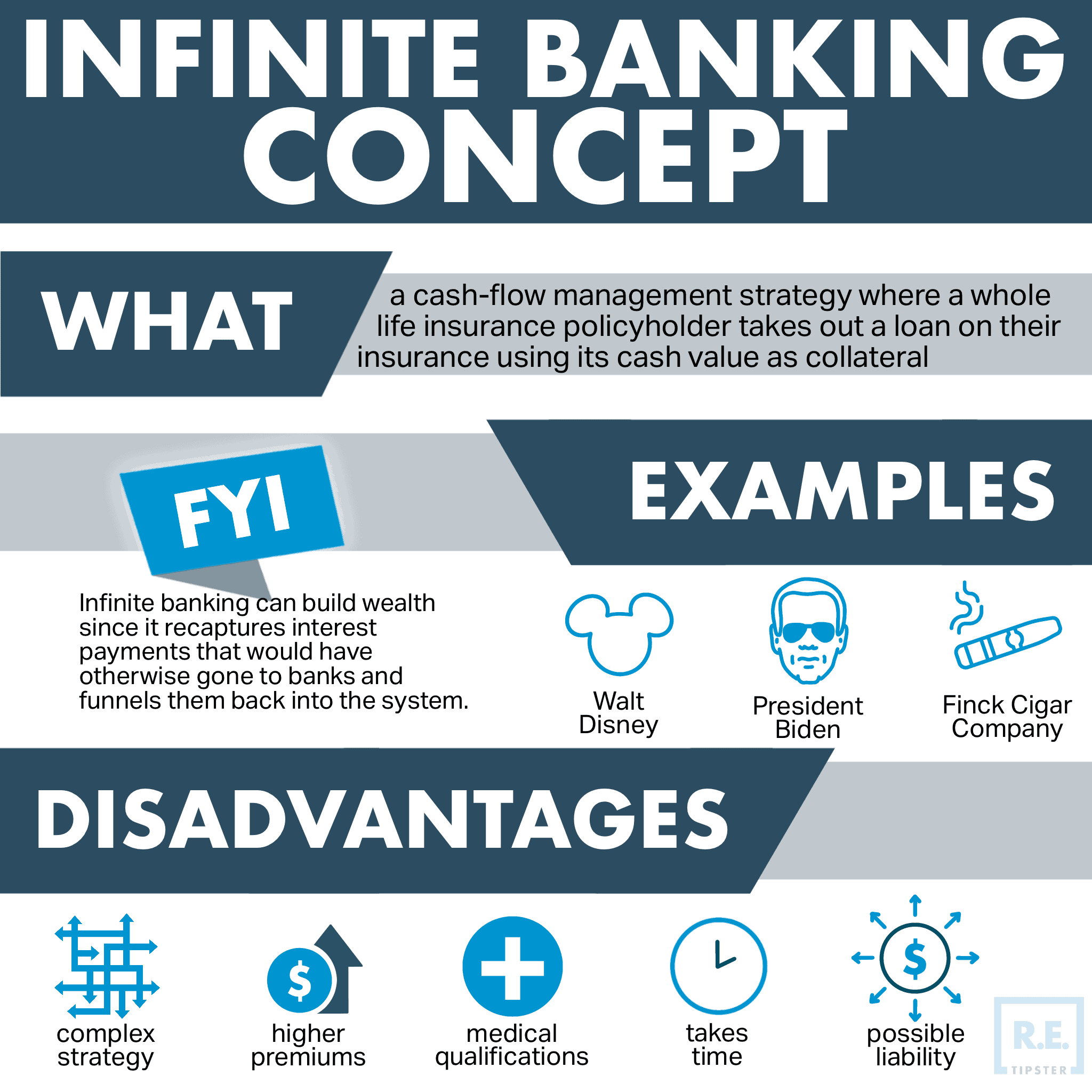

The principle of Infinite Financial was created by Nelson Nash in the 1980s. Nash was a money professional and fan of the Austrian school of business economics, which supports that the value of items aren't clearly the result of conventional economic structures like supply and demand. Rather, people value cash and goods differently based upon their financial standing and needs.

One of the challenges of standard banking, according to Nash, was high-interest prices on financings. Long as financial institutions set the rate of interest prices and finance terms, people didn't have control over their own wealth.

Infinite Financial needs you to own your monetary future. For ambitious individuals, it can be the very best monetary tool ever before. Right here are the advantages of Infinite Banking: Perhaps the single most helpful element of Infinite Financial is that it boosts your capital. You do not need to experience the hoops of a conventional financial institution to get a finance; merely demand a plan lending from your life insurance coverage firm and funds will certainly be made offered to you.

Dividend-paying entire life insurance coverage is really reduced threat and offers you, the insurance holder, a fantastic bargain of control. The control that Infinite Banking uses can best be organized right into 2 categories: tax benefits and asset securities.

Bank Cipher Bioshock Infinite

When you make use of whole life insurance policy for Infinite Banking, you enter into a personal contract between you and your insurance firm. This privacy supplies particular possession defenses not found in various other financial lorries. These defenses might vary from state to state, they can consist of security from possession searches and seizures, protection from reasonings and defense from lenders.

Whole life insurance coverage plans are non-correlated assets. This is why they function so well as the economic foundation of Infinite Financial. Despite what takes place in the marketplace (supply, realty, or otherwise), your insurance coverage plan keeps its well worth. Too numerous individuals are missing this important volatility buffer that aids shield and expand wide range, instead breaking their money into two buckets: financial institution accounts and investments.

Market-based investments grow wealth much faster yet are subjected to market changes, making them naturally high-risk. Suppose there were a 3rd pail that supplied safety however likewise modest, surefire returns? Whole life insurance policy is that 3rd bucket. Not only is the rate of return on your whole life insurance policy policy guaranteed, your survivor benefit and premiums are likewise ensured.

This structure aligns completely with the principles of the Perpetual Wide Range Approach. Infinite Financial appeals to those seeking greater financial control. Right here are its major advantages: Liquidity and accessibility: Plan car loans offer instant accessibility to funds without the limitations of traditional small business loan. Tax obligation performance: The money value expands tax-deferred, and plan lendings are tax-free, making it a tax-efficient device for building wide range.

Build Your Own Bank

Possession defense: In many states, the cash money worth of life insurance policy is protected from lenders, including an additional layer of economic security. While Infinite Financial has its merits, it isn't a one-size-fits-all solution, and it comes with substantial downsides. Right here's why it might not be the finest technique: Infinite Financial usually needs elaborate plan structuring, which can perplex insurance policy holders.

Imagine never having to fret concerning bank finances or high interest rates once more. That's the power of limitless banking life insurance policy.

There's no collection car loan term, and you have the liberty to select the settlement routine, which can be as leisurely as paying off the lending at the time of fatality. This versatility expands to the servicing of the loans, where you can select interest-only repayments, keeping the lending balance level and manageable.

Holding cash in an IUL taken care of account being attributed interest can typically be far better than holding the cash money on down payment at a bank.: You have actually always desired for opening your own pastry shop. You can borrow from your IUL policy to cover the preliminary costs of renting out a room, buying devices, and employing personnel.

How To Set Up Infinite Banking

Individual fundings can be acquired from standard banks and credit scores unions. Obtaining money on a credit card is typically really pricey with annual percentage rates of rate of interest (APR) frequently reaching 20% to 30% or even more a year.

The tax treatment of plan lendings can differ substantially relying on your nation of house and the specific terms of your IUL policy. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, plan car loans are typically tax-free, offering a considerable benefit. In other jurisdictions, there might be tax obligation implications to think about, such as possible tax obligations on the finance.

Term life insurance policy just supplies a fatality benefit, without any type of cash value build-up. This implies there's no cash worth to borrow versus. This article is authored by Carlton Crabbe, President of Resources for Life, an expert in providing indexed global life insurance policy accounts. The information offered in this post is for educational and informative functions just and should not be construed as financial or investment guidance.

For finance policemans, the extensive regulations enforced by the CFPB can be seen as difficult and restrictive. First, car loan policemans commonly suggest that the CFPB's policies create unnecessary bureaucracy, resulting in more documentation and slower financing handling. Guidelines like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) needs, while focused on protecting customers, can result in hold-ups in shutting offers and raised operational costs.

Latest Posts

Infinite Financial Systems

Infinite Banking Concept Explained

Infinite Banking Illustration